The Egyptian banking sector is different from any banking sector in the world because in Egypt it is an important part and a fundamental role in economic development and the strong financial arm of the Egyptian state. At all times, the banking sector proves that it is responsible and does not forget its societal and environmental responsibilities, in addition to its professional banking work, in addition to the extensive banking experience that it has replaced. Trust of global financial institutions.

On a memorable night in the Egyptian banking sector, the Arab African International Bank launched the first sustainable bonds in the Egyptian market, worth $500 million, with the International Finance Corporation (IFC), the European Bank for Reconstruction and Development (EBRD), and the British Bank for International Investment (BII). This is a huge number. very..

By the way, these bonds are considered the first sustainability bonds in Egypt, and also the largest bonds issued by a private bank in Africa, and the International Finance Corporation is contributing $300 million, in addition to $100 million provided by the European Bank for Reconstruction and Development, and $100 million provided by the British Foundation. For international investment, 75% of bond proceeds were allocated to green financing, such as energy efficiency programs in the industrial sector, small-scale renewable energy projects, and environmentally friendly buildings, and 25% was also allocated From proceeds to social development efforts, including comprehensive finance and micro, small and medium enterprises

Ok, what is the purpose of the agreement and this huge number?

Take a look at the sustainable bond agreement, which aims to enhance Egypt’s transition to a green economy and support medium, small and micro enterprises.

These bonds also support the transition towards a more sustainable economy, and are part of the Egyptian government’s plan in 2023 to reduce greenhouse gas emissions by 37% by 2030. This means that you can say that these bonds will finance environmentally friendly projects by providing financing to companies and projects that will help reduce emissions. thermal or environmental preservation, other than meeting the growing financing needs of small, medium and micro enterprises.

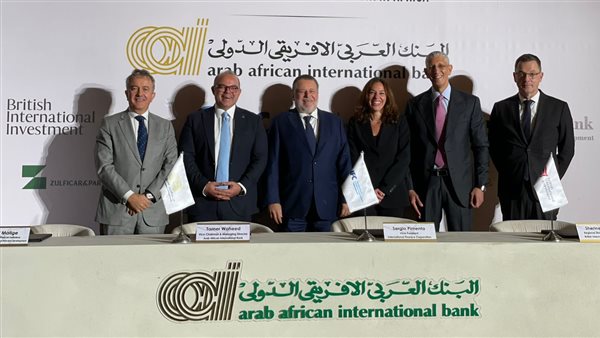

Tamer Waheed, Vice Chairman and Managing Director of the Arab African International Bank, revealed that today’s launch of sustainable bonds is considered a certificate of confidence from international financial institutions and investors in the strength of the financial performance of the Arab African International Bank and the attractiveness of investment opportunities in the Egyptian market.

At the same time, Sergio Pimenta, Vice President of the International Finance Corporation for Africa, confirmed that the new investment is considered a milestone in the path of enhancing financial inclusion and activating the potential of sustainable financing in Egypt.

Also, Francis Mallig, Managing Director of Financial Institutions at the European Bank for Reconstruction and Development, said that as a European financial institution, it is proud to invest in the first sustainability bonds in Egypt, which paves the way for more similar issuances and sets a role model, as this prominent investment will contribute to driving financial flows. capital towards projects that support environmental and social sustainability, and highlights the importance of including environmental and societal criteria in capital markets transactions. Moreover, this project contributes to strengthening the local economy by providing long-term financing in hard currency.”

Sherine Shahdi, Regional Director for North Africa at the British Corporation for International Investment, considered that Egypt is a major market for the British Corporation for International Investment, as evidenced by the increase in the value of the corporation’s portfolio in Egypt to $707.5 million, which includes its investments in 70 companies that have provided more than 91,000 jobs since 2023, and that its focus now in Egypt is directed to Financial services, renewable energy, healthcare, and infrastructure

The Arab African International Bank’s bonds will provide an important source of financing for businesses to transition to environmentally friendly practices, and the institution has committed to providing more than 1.2 billion pounds in financing climate action during the past two years.