I wonder why suddenly Egypt decided to oblige free zone companies to pay for gas consumption in dollars? How can this decision help increase the country’s hard currency resources? Will this have an impact on prices or investment projects? In this video, we will explain the topic to you simply and try to understand its meaning and its real impact on the economy, especially at a time when every pound and every dollar has great value in achieving economic stability.

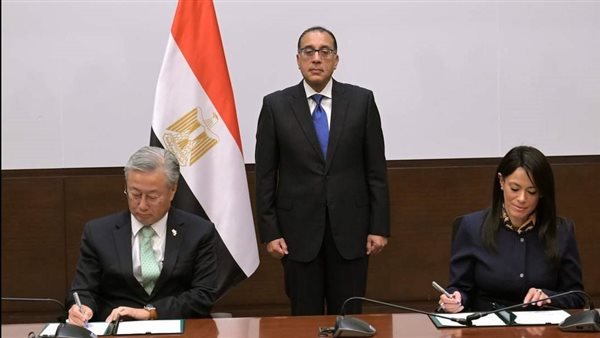

In recent hours, Prime Minister Dr. Mostafa Madbouly issued a decision requiring payment of the value of natural gas consumption for projects in free zones and economic zones in dollars. The Official Gazette stated that the decision also included payment of the value of gas consumption for projects outside the free zones in the equivalent in Egyptian pounds according to the officially announced average price of the dollar. From the Central Bank of Egypt during the month preceding the accounting period

What does the decision mean?

The new decision says that companies operating in free zones and economic zones will pay for their consumption of natural gas in dollars, while the rest of the projects outside these areas will be paid in Egyptian pounds, but based on the average official dollar price announced by the Central Bank for the past month.

In other words, the government wants to benefit from companies that have income in dollars, such as exports, by paying in this currency instead of the pound, and this directly helps the country in increasing its hard currency resources.

Why this decision?

Egypt has recently been trying in every way to increase its foreign currency resources in order to face the shortage of hard currency because the economy needs dollars to pay obligations such as debts and import basic goods. Egypt is also committed to an agreement with the IMF that includes economic reforms, including strengthening foreign reserves and applying an exchange rate. Flexible.. Also take care when companies pay in dollars, the government reduces its demand to buy dollars from the market, and this may help stabilize the exchange rate.

Does it have an impact on companies and investors?

Companies operating in free zones and economic zones often deal in dollars because their work is export-oriented, so the decision will not be a huge burden on them. On the contrary, these companies will benefit from the presence of a clear accounting system based on the official price of the dollar, and this reduces any risks in the evaluation…but companies that rely partially The local market may face challenges if its primary income is in pounds, and this puts pressure on its profits

But apart from who earns and whose profits will be reduced, let us look at the picture more broadly. When companies pay in dollars, this adds to the government a sustainable source of hard currency instead of having to buy it from the market. This decision is a small but effective step in supporting the foreign reserve to face any crises or financial obligations… and the government is trying. A balance between market requirements and the conditions of the IMF to prevent any new decline in the pound, and Dr. Madbouly said it frankly: “There will not be a float in the true sense of the word, the dollar will increase and decrease according to the market.”

Could this raise prices?

The decision itself is not related to the average consumer because it targets companies, but if companies decide to bear this cost on products, there may be an increase in the prices of some goods destined for the local market.