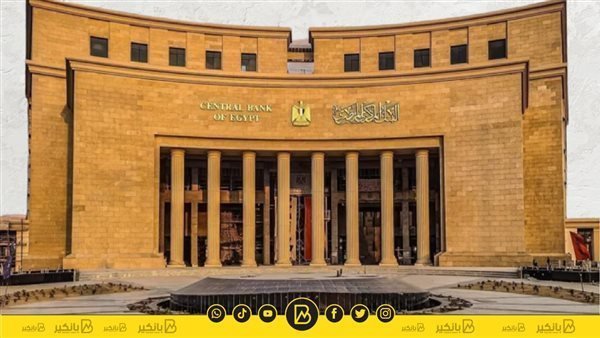

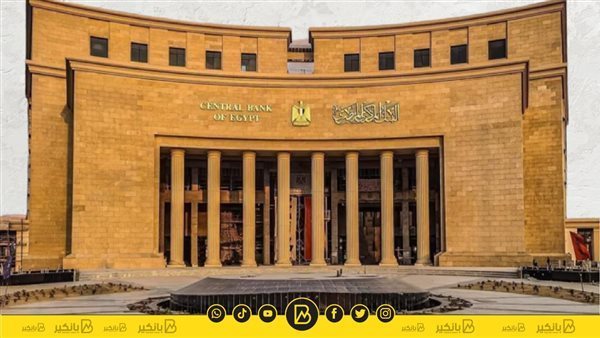

The Central Bank has taken a very important step in reducing the pressure and demand on the dollar, and this step will create a large abundance of foreign currencies in Egypt. I wonder what this step will be.. What will it reduce the pressure on the dollar? Follow us until the end and you will know the details.

In the new presidential period, the political leadership directed the government to strike an economic balance between exports and imports, and reduce dependence on foreign resources, especially the dollar, for imports. This is actually what the government has done, and it has actually taken an important step that will significantly reduce the rates of demand for the dollar to import many types and goods that suppliers and importers buy to cover Local market needs from abroad.

Ok, what is the step taken by the Central Bank and how will it reduce the pressure on the dollar in Egypt?

Look, Your Honor.. Officially, the Central Bank announced its joining the African Payment and Settlement System (Pass), affiliated with the African Export-Import Bank (Afrixim Bank). This is a step aimed at enhancing trade between Egypt and African countries, and this system (Pass) is an innovative platform that allows the settlement of cross-border payments and transfers easily and at a reduced rate. Cost and time to implement it.

The Central Bank aims with the new step to reduce pressure on foreign currencies, enhance economic cooperation with African countries, and expand mutual trade between Egypt and African countries.

One of the advantages that the African Payments and Settlements System will provide is to encourage banks operating in Egypt and African banks to expand financial transactions between them, especially since this system includes 14 central banks from the countries of Nigeria, Ghana, Liberia, the Republic of Guinea, Zambia, Sierra Leone, Djibouti, Zimbabwe, Zambia, Kenya, Rwanda, Malawi, Tunisia, and the Comoros. This is in addition to 50 commercial banks, and a large number of banks that exist and operate In Egypt, it announced its desire to enter the African system of payments and settlements.

The new agreement signed by the Central Bank of Egypt also includes monitoring the participation of banks operating in Egypt in the payments and settlements system. It will help increase the volume of trade between Egypt and the countries of the African continent and will strengthen Egypt’s economic relations with African countries. It will also help achieve financial integration between the countries of the African continent, and will facilitate supply. of foreign currencies through the net transaction settlement mechanism between countries participating in the African system.