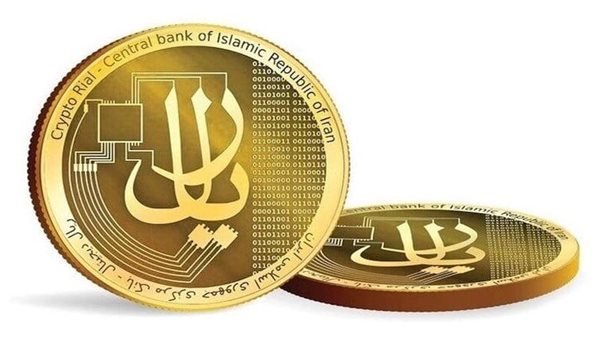

The Central Bank of Iran intends to launch its own digital currency, the digital rial, in the near future as part of a larger effort to modernize the country’s banking system and improve international financial cooperation.

Mohammad Reza Farzin, Governor of the Central Bank of Iran, revealed the upcoming plans to launch the digital riyal during the 11th Annual Conference on Modern Banking and Payment Systems.

In his speech, Ferzin described the conference as an opportunity to review policies and determine the future course of the banking system.

“As governor, this platform allows me to evaluate strategies and determine the path forward. We will incorporate the ideas shared here into our policy making,” he said.

Farzin highlighted the strengths and challenges faced by the Iranian banking system, emphasizing its strong digital infrastructure.

He pointed out that “the Iranian payment network Shatab, in which transactions are processed in less than two seconds, is among the most efficient in the region.”

He stressed the imminent operation of the digital riyal, stressing the central bank’s commitment to developing modern banking practices.

“Developing innovative banking systems is the responsibility of central banks around the world, and we are determined to fulfill this duty in Iran,” Farzin added.

Speaking about international banking interactions, Ferzin acknowledged the challenges posed by sanctions but pointed to progress in alternative solutions.

“Sanctions remain a major obstacle, but we have made notable strides in recent years,” he said, citing the implementation of the ACU-MIR system.

Designed for Asian financial cooperation, this platform is positioned as an alternative to SWIFT, enabling transactions with countries such as India and Pakistan.

Farzin explained that the ACU-MIR system became fully operational on October 2 and strengthened Iran’s ability to effectively manage sanctions.

“We have replaced SWIFT with this platform and strengthened our relations with the BRICS group, which shapes global trade with a strategic plan until 2025,” he said, adding that the plan focuses on expanding the use of local currencies, and creating opportunities for Iran to integrate into the system.

“China and Russia are already moving forward in this direction, and we aim to settle transactions using BRICS currencies,” Ferzin noted. He also mentioned a cross-border settlement platform currently in its early stages, which could further facilitate international financial exchanges.

Regarding regional connectivity, Farzin provided details of efforts to connect the Iranian payment network Shatab to the Russian Mir system.

“Recently, Shtab has been linked to the Russian Mir system, and many banks are now working on the system,” he said.

While the rollout is still in its early stages, he expressed optimism about the gradual expansion.

Future plans include enabling Russian tourists to use Iranian POS systems this winter and allowing Iranian tourists to access Russian POS services by early 2025.